By Otto Fajen, MNEA Legislative Director

Trustees present: Jason Steliga (Chair), Chuck Bryant, Allie Gassman, Beth Knes (Vice-Chair), Dr. D. Eric Park, Katie Webb

BUDGET AND AUDIT COMMITTEE MEETING

Prior to the meeting of the Board of Trustees, the Budget and Audit Committee met at 8:30 a.m. to review and approve the Annual Banking Resolution that allows the administrators of the Systems to work with Central Bank without requiring further Board action on the details of each action.

The staff presented the FY 2025 budget proposal, and the Committee approved the budget for recommendation to the Board. The largest part of the budget is the payment of member benefits. The budget also includes investment fees and expenses, and administrative expenses. Investment expenses are increasing as the Systems make more private equity investments. The Board reviewed the various expense categories within the broad categories of personnel, professional services, and operations.

SYSTEM OPERATIONS

The Board approved the minutes from the April 14, 2024, meeting and established the order of business.

INVESTMENTS

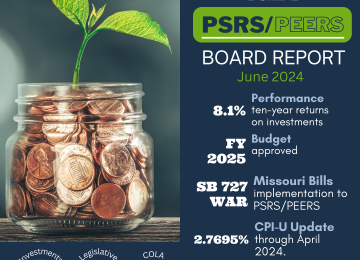

Investment Performance Report - Craig Husting reviewed the estimated May 31, 2024, investment results. US markets have been showing higher returns than non-U.S. equity returns in recent quarters, but equities continue with high returns. The Systems have an 8.1% return over a 10-year timeline and have outperformed the 60/40 portfolio benchmark, which has yielded 6.0% over a 10-year period.

For FY 2024, the Systems have a net return of 8.8%. For the first quarter of calendar 2024, the Systems have a return of 4.6%. Total System assets are $58.1 billion. The investment report provided a broad overview of how the PSRS/PEERS’ portfolio was structured, including estimated asset allocation for PSRS/PEERS as of May 31, 2024.

Real Estate Portfolio – Staff provided the annual review of the Real Estate Portfolio. Real Estate is part of the Private Credit Portfolio. The role of Real Estate in the PSRS/PEERS portfolio is to provide a stable income stream, capture property appreciation, serve as a hedge against inflation, and provide diversification in the portfolio.

The Systems’ Real Estate portfolio includes three categories. Core properties are existing, income-producing properties that are at least 80% percent leased. Core properties have high-quality tenants and conservative leverage. Non-core properties include value-add and opportunistic strategies. These are usually under-utilized or distressed properties that require specialized skills to enhance the value of the property through leasing, repositioning, and/or complete renovation. Infrastructure properties are hard, physical assets with a long duration (including toll roads, ports, sewer systems, and utilities) that provide the services and systems necessary for a society to function.

Real Estate has historically had a low correlation to other asset classes and is expected to generate returns greater than bonds and less than stocks with lower volatility (risk) than stocks. Staff expects the Real Estate Portfolio to outperform the Real Estate benchmark, the NCREIF Fund Index Open End Diversified Core Equity (NFI-ODCE) net of fees, over a rolling 5-year period.

The Systems continue to maintain a long-term relationship with a real estate consultant, Townsend Group. The Riverside Company (“Riverside”) recently acquired Townsend. Riverside is comprised of Bluerock, MLC Private Equity, and Ten Capital Management. BlueRock will work with Townsend to expand institutional investment.

Over the last 10 years, the Real Estate Portfolio has generated a net gain of $2.8 billion. Over a rolling 5-year period, the Real Estate Portfolio has outperformed its benchmark and returned 6.30%. Within the last year, the real estate sector has experienced net losses. The Systems have shifted the portfolio to include more industrial properties and fewer retail and office properties. The Real Estate Portfolio net returns over the last year are -7.79%, but this represents outperforming the benchmark by 4.00%. Staff believe the real estate sector is beginning to stabilize.

MANAGEMENT REPORT

Meeting Dates – The Board approved its meeting dates for FY 2025:

August 26, 2024

October 28, 2024

December 16, 2024

February 3, 2025

April 7, 2025

June 10, 2025

Banking Resolution – The Board approved the Annual Banking Resolution that allows the administrators of the Systems to work with Central Bank to make needed changes to their banking relationship without requiring further Board action of the details of each action.

Budget – The Board approved the Systems’ FY 2025 budget as recommended Staff and approved by the Budget and Audit Committee. The largest part of the budget is the payment of member benefits. The budget also includes investment fees and expenses, and administrative expenses.

Implementation of Regulations Due to SB 727 – The Board approved a motion to file proposed regulatory changes as proposed by staff due to changes in law due to SB 727 and other emerging regulatory needs. A staff working group created proposed regulatory changes. The regulations will have no impact on funds, no negative impact to members, and impose no new burdens on trustee candidates or associations. The rules modernize provisions regarding board elections, change of position, extra duty, and working after retirement. The staff presented draft language that was approved by the Board.

The proposed rule allows districts to determine what is “extra duty” other than specified fringe benefits, rather than having the Systems determining extra duty. The rules implement all new statutory changes regarding working after retirement. All changes are applied to both PSRS and PEERS Systems.

Proposed rules could be filed with the Secretary of State by July 15, 2024, and could become effective as early as December 2024.

Legislative Report – Mike Moorefield gave the legislative report. The Governor has until July 14th to sign bills. The normal effective date for bills is August 28. Moorefield gave an overview of the legislative context and how the legislative session ended, noting that few bills passed and that no bill passed that would negatively affect the Systems.

Special Session will likely, at least for the Medicaid budget, provide additional spending authority. There are also rumors of a possible special session on an economic incentive package intended to keep the Chiefs in Missouri.

System improvements that passed in SB 727 (Andrew Koenig) – Three of the Systems’ positive retirement issues were enacted in SB 727. These working after retirement (WAR) improvements include: 1) reducing the WAR penalty to actual over-earnings, 2) removing the disability block on WAR, and 3) allowing the employer to set the WAR salary if no previous salary or schedule exists.

SB 898 (Rusty Black) became a pension omnibus bill but did not pass. The bill passed both chambers, but in different forms, and was among the bills that died in the last week of session, due to Senate dysfunction. SB 898 included the three WAR components enacted in SB 727, along with a provision to add a 2.6% benefit factor for 33 or more years of PSRS service. SB 898 was amended in the House committee. The House wanted a vote on a China disinvestment amendment, so the bill was amended on the floor with language that aligns with the Systems’ current policy. The bill was returned to the Senate. However, the Senate only filibustered the initiative petition (IP) measure during the final week and did not work on any other bills, including SB 898.

Key accomplishments – Staff reviewed recent staff work in the key areas, including improving member data online security, Hiring of Director of Human Resources, IT Asset Inventory Migration to Lansweeper, one positive bill and no negative bills for the Systems passed in 2024.

CPI update/COLA review – The Board reviewed the COLA policy and COLA history for the current fiscal year. The current CPI-U is up 2.7695% through April 30, 2024. Under current policy, the Board will make a COLA for eligible retirees for next year if the cumulative figure at the end of this fiscal year exceeds 2.0%. At this point, it appears likely that eligible retirees will receive a 2.0% COLA in January 2025.

Public Comment – None.

The public meeting adjourned, and the Board went into a closed session.

Read past reports at www.mnea.org/psrs.